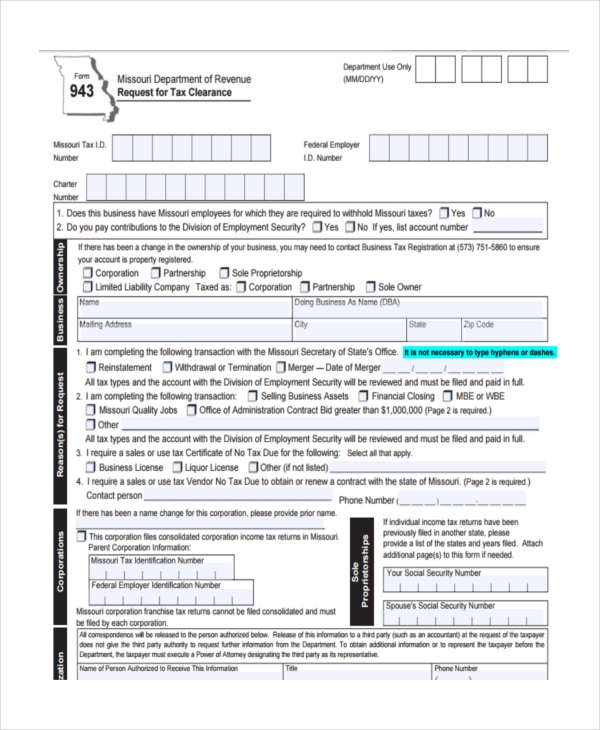

Application For Tax Clearance Certificate - Application For Tax Clearance Certificate Online ~ Form ... _ This form is to obtain a revenue clearance certificate needed to dissolve a corporation with the secretary of state.

Application For Tax Clearance Certificate - Application For Tax Clearance Certificate Online ~ Form ... _ This form is to obtain a revenue clearance certificate needed to dissolve a corporation with the secretary of state.. If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. The taxes that might be covered in a clearance certificate for a business include sales tax, use tax, franchise or corporate tax, unemployment tax, and other types of taxes, depending on the laws and requirements of each state. Application forms from other sources may be denied. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). If your business is a washington state llc, pllc, lp or an llp, this application is not necessary.

Tax clearance letter (479.28 kb) department of revenue. With the introduction of the new tax compliance status system, one can now print a tax clearance certificate online. Who will request a tax clearance certificate from you? Suppliers prospective clients to be listed as a service provider for large corporate and government institutions. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland).

If your business is a washington state llc, pllc, lp or an llp, this application is not necessary.

If your business is a washington state llc, pllc, lp or an llp, this application is not necessary. Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). Apr 04, 2014 · inheritance tax: The system will also generate an electronic access pin to be given to 3rd parties. Who will request a tax clearance certificate from you? Request a tax clearance letter for individuals and businesses for all tax types. I have completed the sale of my business or business assets and require a tax clearance certificate. General information — to be completed by all applicants. Tax clearance letter (479.28 kb) department of revenue. This form is to obtain a revenue clearance certificate needed to dissolve a corporation with the secretary of state. Contact the tax commission to request tax clearance application. Once a successful application has been done via sars efiling, the system will generate a valid tax clearance certificate for the use by the tax payer.

For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). A tax clearance certificate is declaration from sars to a 3rd party that the specific individual or entity is 100% compliant with regards to all tax affairs. Request a tax clearance letter for individuals and businesses for all tax types. Who will request a tax clearance certificate from you? Once a successful application has been done via sars efiling, the system will generate a valid tax clearance certificate for the use by the tax payer.

L complete part 1, part 3, and part 4 only part 1:

Disclosure is voluntary and you will not be penalized for refusal. With the introduction of the new tax compliance status system, one can now print a tax clearance certificate online. If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. Contact the tax commission to request tax clearance application. Application for a clearance certificate (iht30) ref: For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). Tax clearance letter (479.28 kb) department of revenue. The taxes that might be covered in a clearance certificate for a business include sales tax, use tax, franchise or corporate tax, unemployment tax, and other types of taxes, depending on the laws and requirements of each state. I have completed the sale of my business or business assets and require a tax clearance certificate. If your business is a foreign llc, lp or an llp, this application will be necessary. Suppliers prospective clients to be listed as a service provider for large corporate and government institutions. Apr 04, 2014 · inheritance tax: This form is to obtain a revenue clearance certificate needed to dissolve a corporation with the secretary of state.

If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. Who will request a tax clearance certificate from you? Application forms from other sources may be denied. Request a tax clearance letter for individuals and businesses for all tax types. Application for a clearance certificate (iht30) ref:

If your business is a foreign llc, lp or an llp, this application will be necessary.

A tax clearance certificate is declaration from sars to a 3rd party that the specific individual or entity is 100% compliant with regards to all tax affairs. General information — to be completed by all applicants. With the introduction of the new tax compliance status system, one can now print a tax clearance certificate online. Application for a clearance certificate (iht30) ref: Request a tax clearance letter for individuals and businesses for all tax types. The taxes that might be covered in a clearance certificate for a business include sales tax, use tax, franchise or corporate tax, unemployment tax, and other types of taxes, depending on the laws and requirements of each state. If your business is a washington state llc, pllc, lp or an llp, this application is not necessary. Application forms from other sources may be denied. This form is to obtain a revenue clearance certificate needed to dissolve a corporation with the secretary of state. The system will also generate an electronic access pin to be given to 3rd parties. L complete part 1, part 3, and part 4 only part 1: Once a successful application has been done via sars efiling, the system will generate a valid tax clearance certificate for the use by the tax payer. If your business is a foreign llc, lp or an llp, this application will be necessary.